Updated on 12 May 2025:

Updated on April 17th :

**Presidential Executive Order on Tariff Adjustments for Chinese Goods**

On April 8, 2025 (local time), U.S. President Donald Trump issued an executive order announcing the following tariff measures on goods originating from China (including Hong Kong, China):

1. **Elimination of De Minimis Exemption for Chinese-origin Goods**

For goods shipped via international postal networks:

(1) Effective May 2, 2025 at 12:01 AM EST: A tariff rate of 120% 90% of the goods' declared value will be applied.

(2) From May 2, 2025 at 12:01 AM EST through June 1, 2025 at 12:01 AM EST: A flat tariff of $100$75 per item will be imposed.

(3) Effective June 1, 2025 at 12:01 AM EST: The flat tariff will increase to $200 $150 per item.

2. **Additional 125%+20% (If it is the category under 9903.01.32 or 9903.01.33, the tariff exemption is 125%) 104% Tariff on High-value Chinese Goods**

For Chinese-origin goods valued over $800:

Effective April 9, 2025 at 12:01 AM EST: An additional tariff of 125% 104% will be applied to these products.

3.DHL Official: Temporarily suspend service for B2C shipments (to individuals in the United States) with a declared value exceeding 800 US dollars.

4.Fedex Official: For B2C shipments, a valid FedEx account number is required.

Note: All times mentioned are in U.S. Eastern Standard Time (EST).

Regarding the latest US tariff policy, I-tech electronics co.,ltd will temporarily maintain the DDP/DTP charges unchanged.

Expected situation:

If the category is under 9903.01.32 or 9903.01.33, the equivalent tariff is exempted by 125%:

20% (fentanyl) +25% (if 232 surcharges are involved) +25% (if 301 surcharges are involved) + exemption from equivalent tariffs + most-favored-nation rates ranging from 0% to 6.5%, with some combined rates reaching 45% to 76.5%

Other:

20% (fentanyl) +125% equivalent tariff +25% (if 301 surcharge is involved) + most-favored-nation rates ranging from 0 to 6.5%, with some combined rates reaching 145% to 176.5%

Note:

8471 is under the U.S. HS exemption code of 9903.01.32 and is not related to Section 232.

The exemption scope of 9903.01.32 includes semiconductors, as well as some goods listed by the United States within the HS list.

The applicable exemption scope of 9903.01.33 includes automobiles and some parts and components, and it is related to the Section 232 list.

9903.01.63 refers to goods other than those within the scopes of 9903.01.32 and 9903.01.33, and an additional 125% tariff will be imposed on them.

===============================================================================================================================================

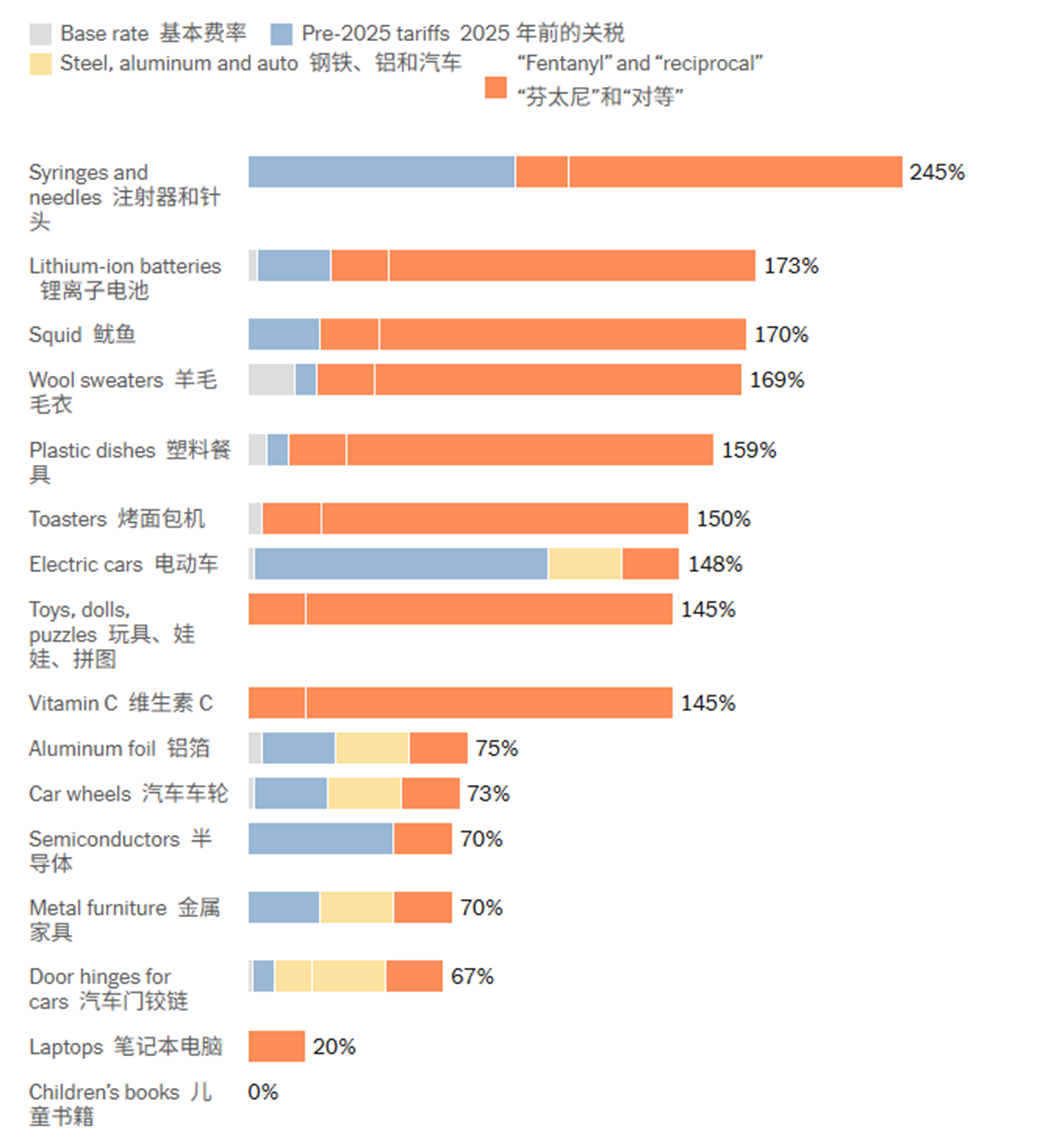

How Much Are Tariffs on Chinese Goods? It’s Trickier Than You Think.

But because of an ever-changing patchwork of trade rules, not every product will be charged an astronomical tariff, trade lawyers, customs brokers and importers say. In some cases, tariffs will pile on other tariffs. In other instances, they can reduce costs, while other times they can cancel out new ones.

The new 125 percent rate that President Trump imposed will in many cases be added on top of long-existing duties. There are four main categories of tariffs that are imposed on goods from China.

Note: The tariff on auto parts comes into effect in early May. The average provided for the base rate is calculated by the World Trade Organization, which computes an average of all tariff lines. A large share of U.S. imports are assigned a 0% duty, but there are some very high rates in the tariff schedule.

Rates ultimately depend on what is imported, what materials are used (from where), which special rates are applied and what sorts of products are exempt.

New tariff rates on select goods from China

Note: Rates are rounded to the nearest whole number. The rates are calculated assuming metal furniture made of 100 percent aluminum and door hinges made of 50 percent aluminum.

=================================================================================================================================================

Updated on April 12th 11th

U.S. Customs Announcement on Tariff Exemptions

Eastern Time, April 11 Evening – U.S. Customs and Border Protection (CBP) announced that, pursuant to a memorandum signed by President Donald Trump earlier today, the following HTS codes will be exempt from the "reciprocal tariffs" imposed under Executive Order 14257 (the "April 2 Order," later amended on April 8 and 9).

As a result, goods originating from China under these HTS codes will no longer be subject to the 125% reciprocal tariff:

HTS Code Product Description

8471 Automatic data processing machines and units thereof; magnetic or optical readers, machines for transcribing data onto data media in coded form, and machines for processing such data.

8473.30 Parts and accessories of the machines of heading 8471, specifically parts and accessories of automatic data processing machines.

8486 Machines and apparatus of a kind used solely or principally for the manufacture of semiconductor boules or wafers, semiconductor devices, electronic integrated circuits, or flat panel displays.

8517.13.00 Smartphones.

8517.62.00 Machines for the reception, conversion, and transmission or regeneration of voice, images, or other data, including switching and routing apparatus.

8523.51.00 Solid-state non-volatile storage devices for the recording of sound or other phenomena.

8524 Records, tapes, and other recorded media for sound or other similarly recorded phenomena.

8528.52.00 Monitors and projectors, not incorporating television reception apparatus, capable of directly connecting to and designed for use with an automatic data processing machine.

8541.10.00 Diodes, other than light-emitting diodes.

8541.21.00 Transistors, with a dissipation rate of less than 1 W.

8541.29.00 Other transistors, not specified elsewhere.

8541.30.00 Thyristors, diacs, and triacs.

8541.49.10 Other photosensitive semiconductor devices, including photovoltaic cells, assembled in modules or made up into panels.

8541.49.70 Other photosensitive semiconductor devices, including photovoltaic cells, not assembled in modules or made up into panels.

8541.49.80 Other photosensitive semiconductor devices, not specified elsewhere.

8541.49.95 Other photosensitive semiconductor devices, not elsewhere specified or included.

8541.51.00 Gallium arsenide light-emitting diodes (LEDs).

8541.59.00 Other light-emitting diodes (LEDs).

8541.90.00 Parts of diodes, transistors, and similar semiconductor devices; photosensitive semiconductor devices, including photovoltaic cells; light-emitting diodes; mounted piezoelectric crystals.

8542 Electronic integrated circuits and microassemblies.

Affected Products Include:

✔ Integrated Circuits (ICs)

✔ Semiconductor Devices

✔ Flash Memory (NAND/NOR Flash)

✔ Smartphones

✔ Tablets

✔ Laptops

✔ Display Modules (LCD/OLED Panels)

Key Implications:

Immediate tariff relief for shipments under these HTS codes

No retroactive refunds for tariffs already paid

Other China-origin goods (outside these codes) remain subject to 125% tariffs

Effective Date: April 11, 2025, 12:01 AM EST

Note:

Importers should verify HTS classifications with customs brokers.

Future policy adjustments may apply; monitor CBP updates.

Source: U.S. CBP Official Bulletin | Issued: April 11, 2025

Updated on April 3rd:

In response to the recent changes in tariff policies, I-tech electronics co.,ltd will temporarily maintain the DDP/DTP charges unchanged.

Updated on 7th Feb:

Latest news on 7th Feb,US time.U.S. Government delays cancellation of de minimis trade exemption targeting China imports:

Here is the news link:https://www.cnbc.com/2025/02/07/trump-delays-ending-of-de-minimis-trade-exemption-targeting-china.html.

Overview:

On February 1, 2025, Eastern Standard Time, the U.S. government announced an additional 10% tariff on all products from China, including the Hong Kong Special Administrative Region.

Details:

On February 3, 2025 (Eastern Time), the U.S. Customs and Border Protection (CBP) announced additional tariffs on imported products originating from China (including Hong Kong). Regardless of their value, all covered imported products will be assessed, and shipments containing such goods will no longer be eligible for the "de minimis" duty and tax exemption under 19 U.S.C. § 1321(a)(2)(C).

The United States will impose an additional 10% tariff on all products from China (including the Hong Kong Special Administrative Region).

The executive order imposing additional tariffs officially took effect at 12:01 AM Eastern Standard Time on February 4, 2025. Shipments arriving after this time or declared for arrival after this time are subject to the order. The "$800 de minimis exemption" and the "T86 clearance model" no longer apply.As a result, shipments from I-tech electronics co.,ltd to the U.S. will incur additional tariffs.

We will continue to optimize our website and services to provide a better experience in response to this situation.

Note: Since this policy has just started, the express delivery may be chaotic. We will update the latest news in time. If you have any questions, you can also ask your I-tech electronics co.,ltd sales rep and she will help you solve it.

Official information from the US government can be found at:

https://public-inspection.federalregister.gov/2025-02293.pdf

We are also waiting for the latest policies of some logistics companies.